Like the 90s music genre, here’s a great Alternative! 🎸

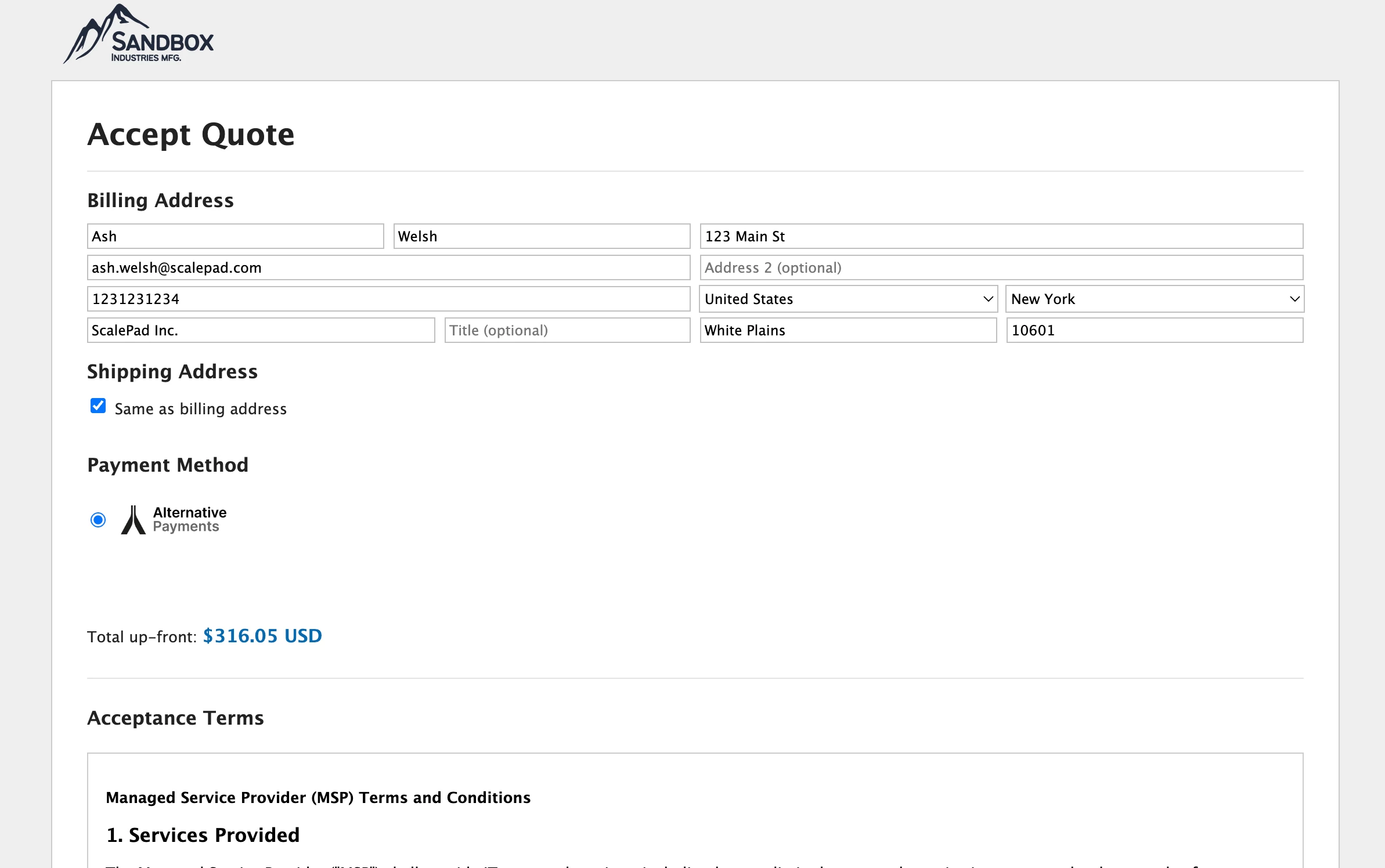

Quoter has expanded its payment options by integrating with Alternative Payments, allowing your MSP to offer a seamless embedded payment experience for clients. Once set up, your clients can conveniently pay any upfront fees via credit card or bank debit/ACH through Alternative Payments.

Quoter manages the quoting process, Alternative Payments handles the transactions, and everything syncs directly with your accounting system. Your clients benefit from a polished experience, while you enjoy a simple and dependable way to transition from quote to payment. Everyone achieves Nirvana, if you will.

- If you’re already signed into Quoter, you can begin by adding Alternative Payments via the Settings page: Add Alternative Payments

- This integration involves several setup steps, and accuracy matters. We recommend following our detailed guide in the Help Center to get started with Alternative Payments.

- Walking is great, low-impact exercise, and Ash has created a step-by-step walkthrough guide to help you configure the integration properly. Get your steps in and check this out:

Why Integrate Quoter with Alternative Payments?

Easy Upfront Payments Collections

Bringing on a new client often involves upfront fees for hardware, onboarding, or implementation. Avoid chasing payments like a collection agency and get the financial relationship off on the right foot by turning accepted quotes into paid invoices in a single step. Clients can accept your quote and complete payment in just a few clicks.

Note that you need to have your client set up as a customer in Alternative Payments; guest checkout is on Alternative’s feature development list but was not available yet at the time of this release.

ACH and Optional Credit Card Surcharge

Credit card fees can erode your margins. While your clients might prefer paying by card for the rewards or convenience, it’s important to maintain your profitability.

Alternative Payments offers flexibility. You can enable an optional surcharge for credit card payments to offset transaction fees, while still offering fee-free ACH transfers as a standard option. Clients get to choose how they pay, and you preserve your margins either way.

- ACH bank transfer (no additional fees)

- Credit card (with optional processing fee)

Providing options at a client level while keeping the workflow simple is a great way to deliver a positive client experience with minimal friction.

Keeping the Integration Secure

Security is a top priority for both Quoter and Alternative Payments; both organizations are SOC 2 Type II and ISO 27001 compliant. All communication on the integration occurs over HTTPS, and secure hashed tokens are used for authentication between systems.

Alternative Payments does not save any payment card information and continuously monitors their third-party providers used to complete transactions.

Setting It Up: A Quick Overview

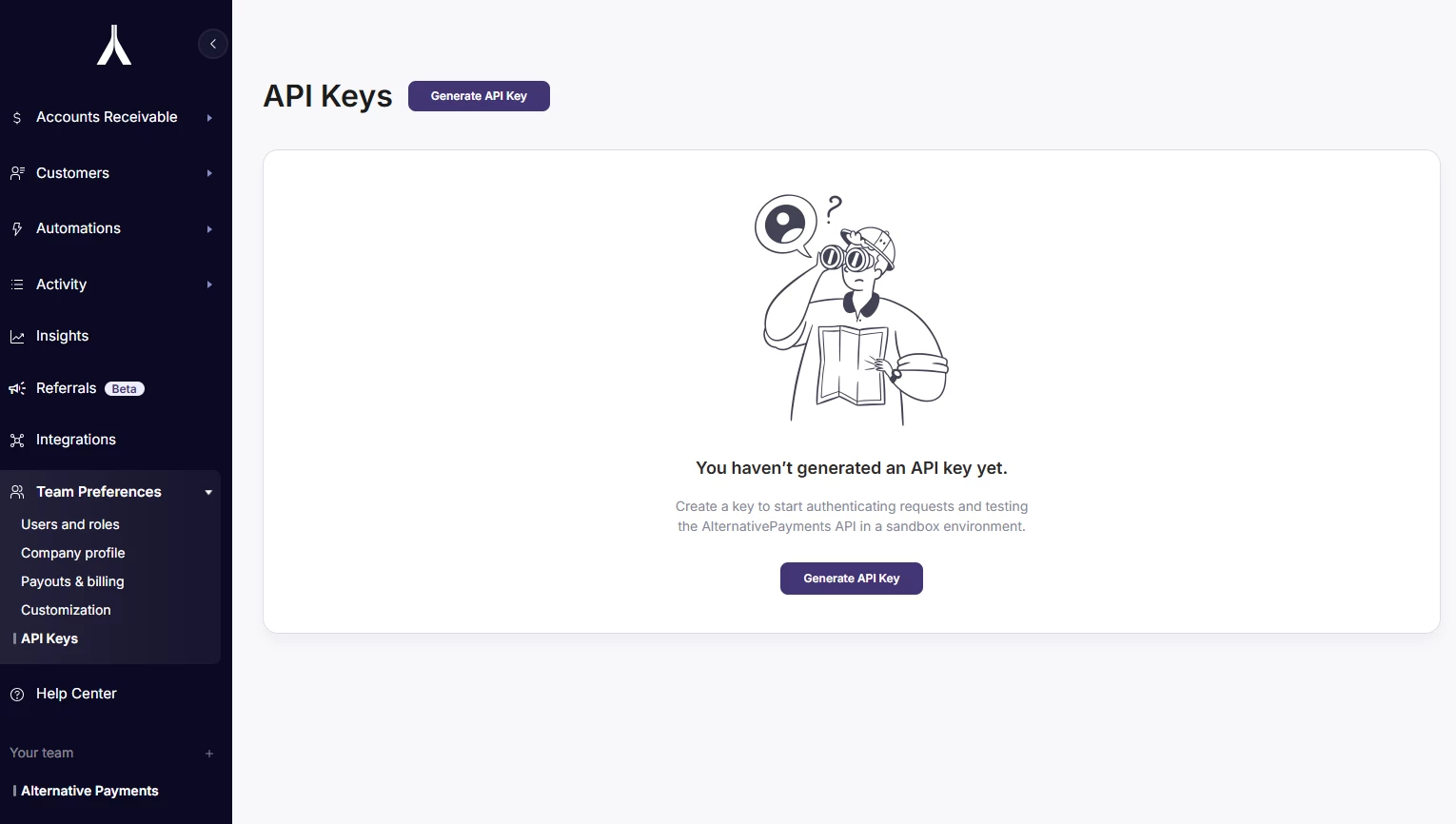

Start by creating an API key in Alternative Payments (here’s their documentation):

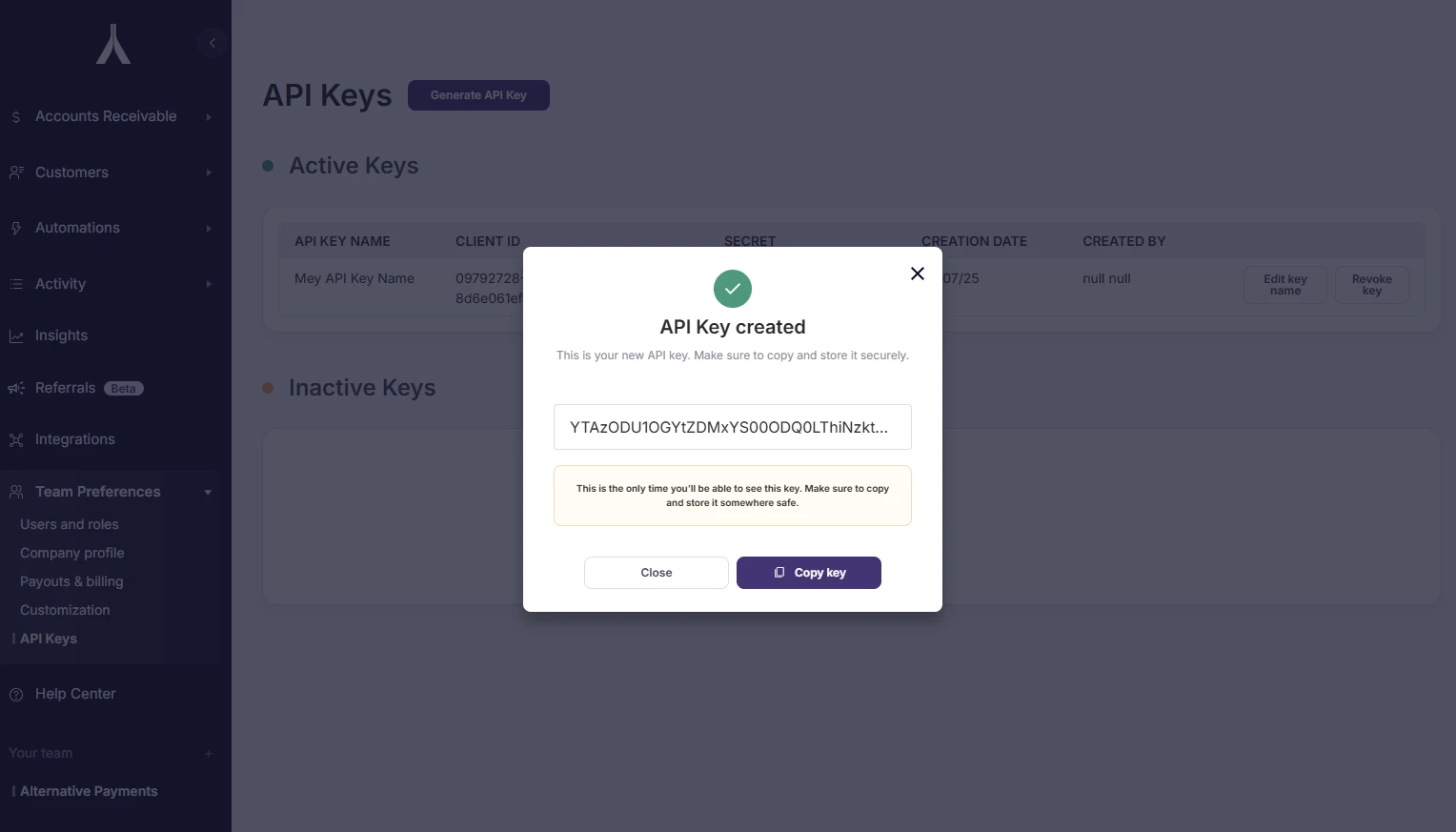

- Go to Team Preferences > API Keys in Alternative Payments.

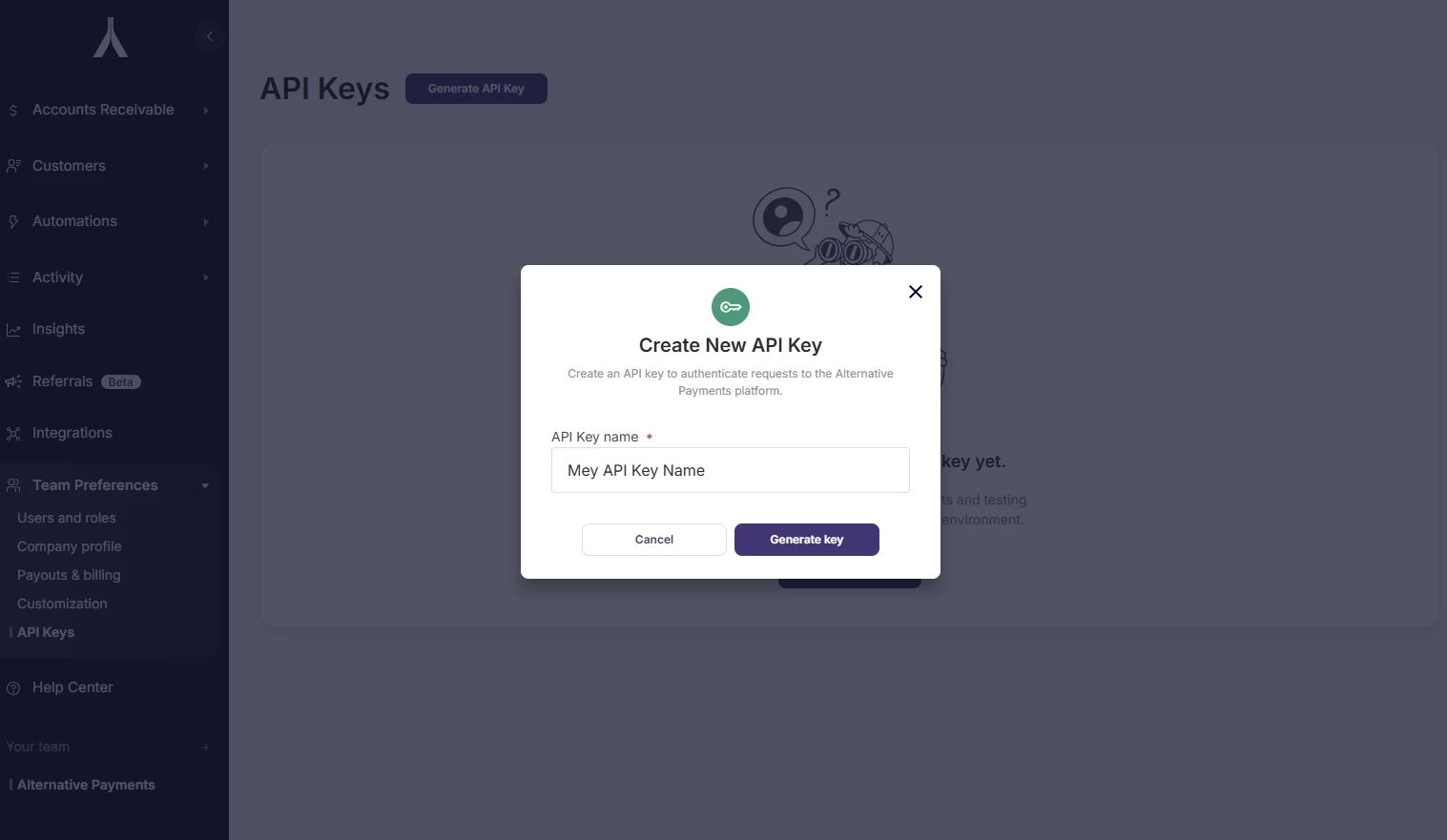

- Click Generate API key

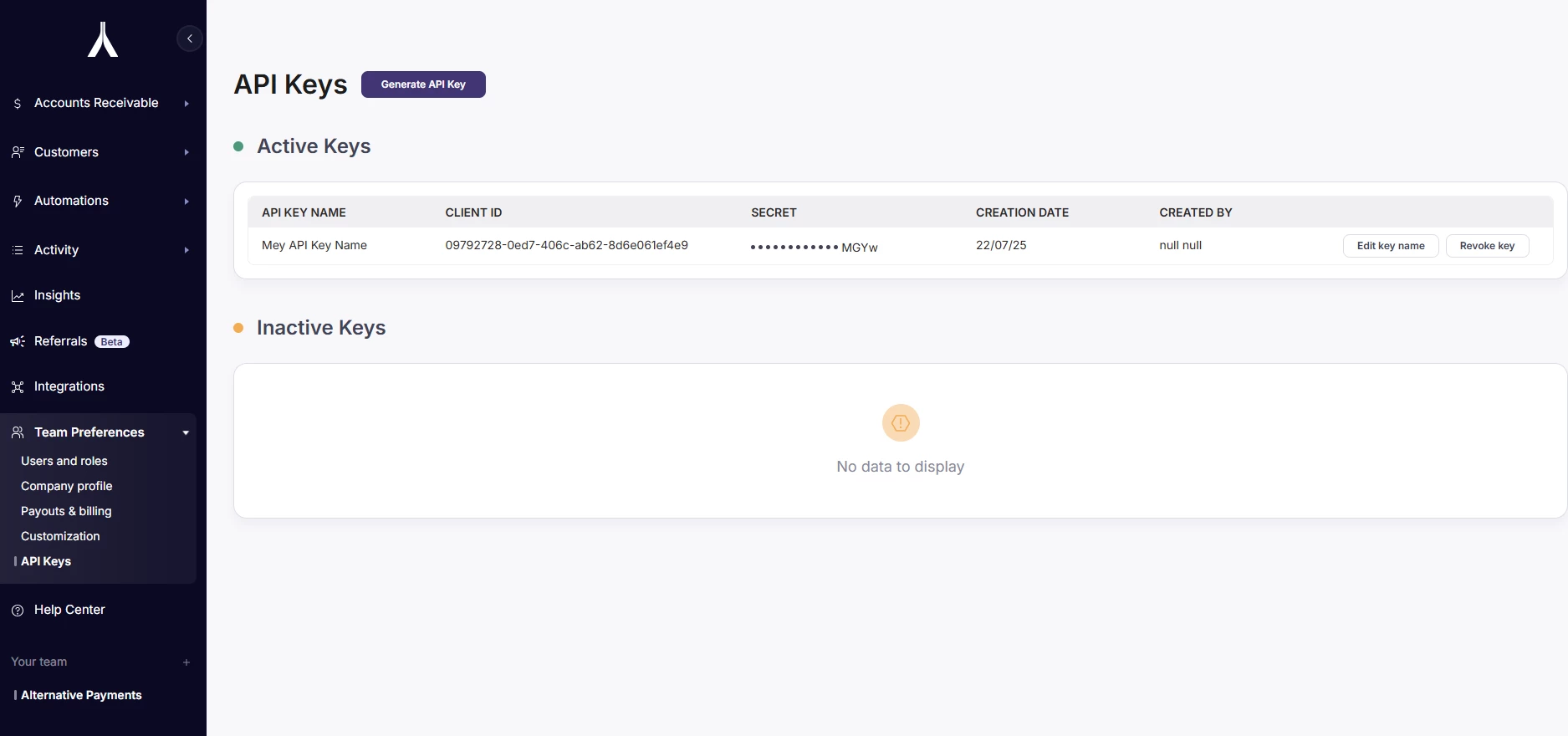

- Name the key Quoter. You can edit this later if you did something like name it Mey API Key Name by hitting Edit key name.

- Copy the newly-created API key.

Then, in Quoter:

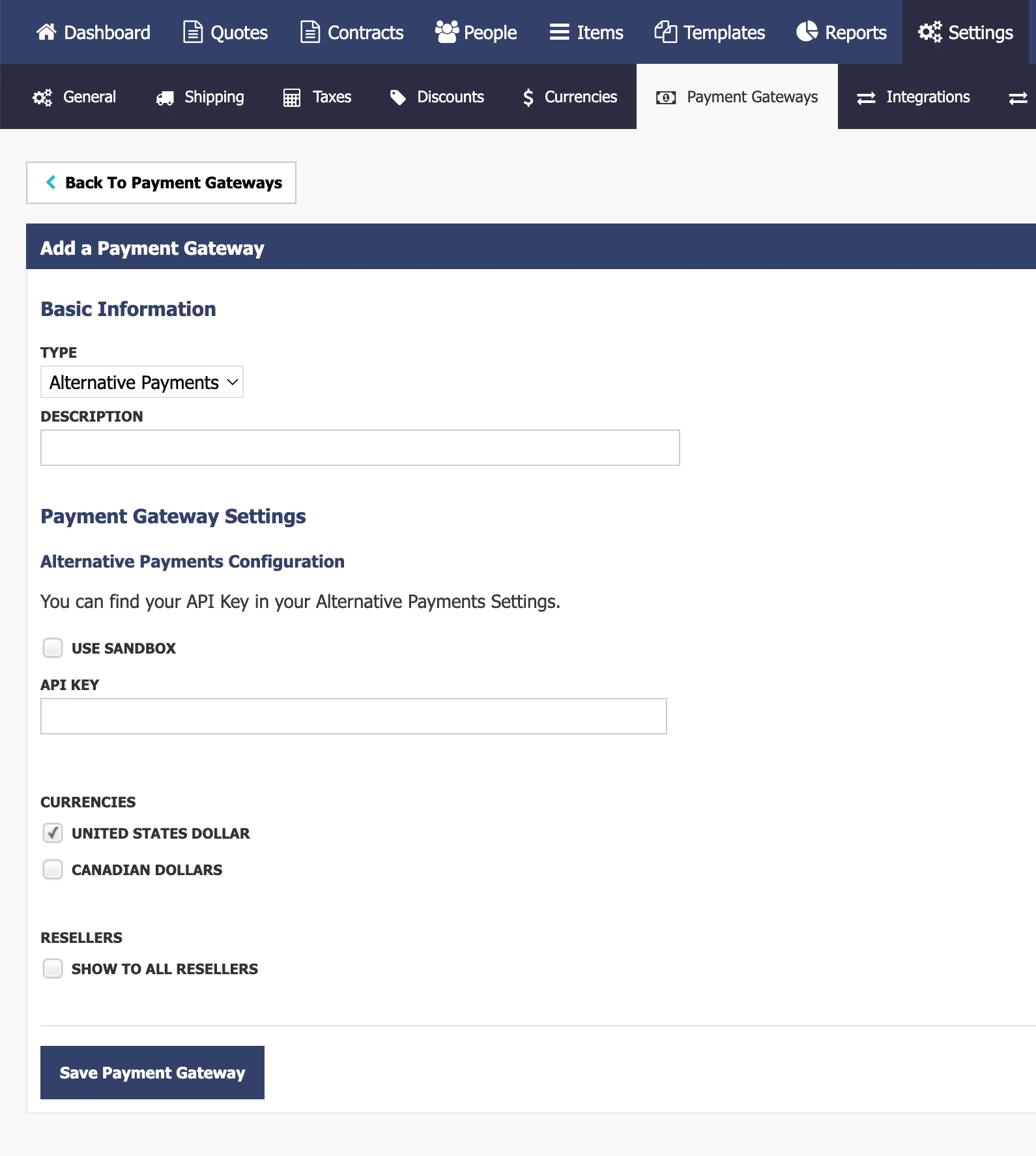

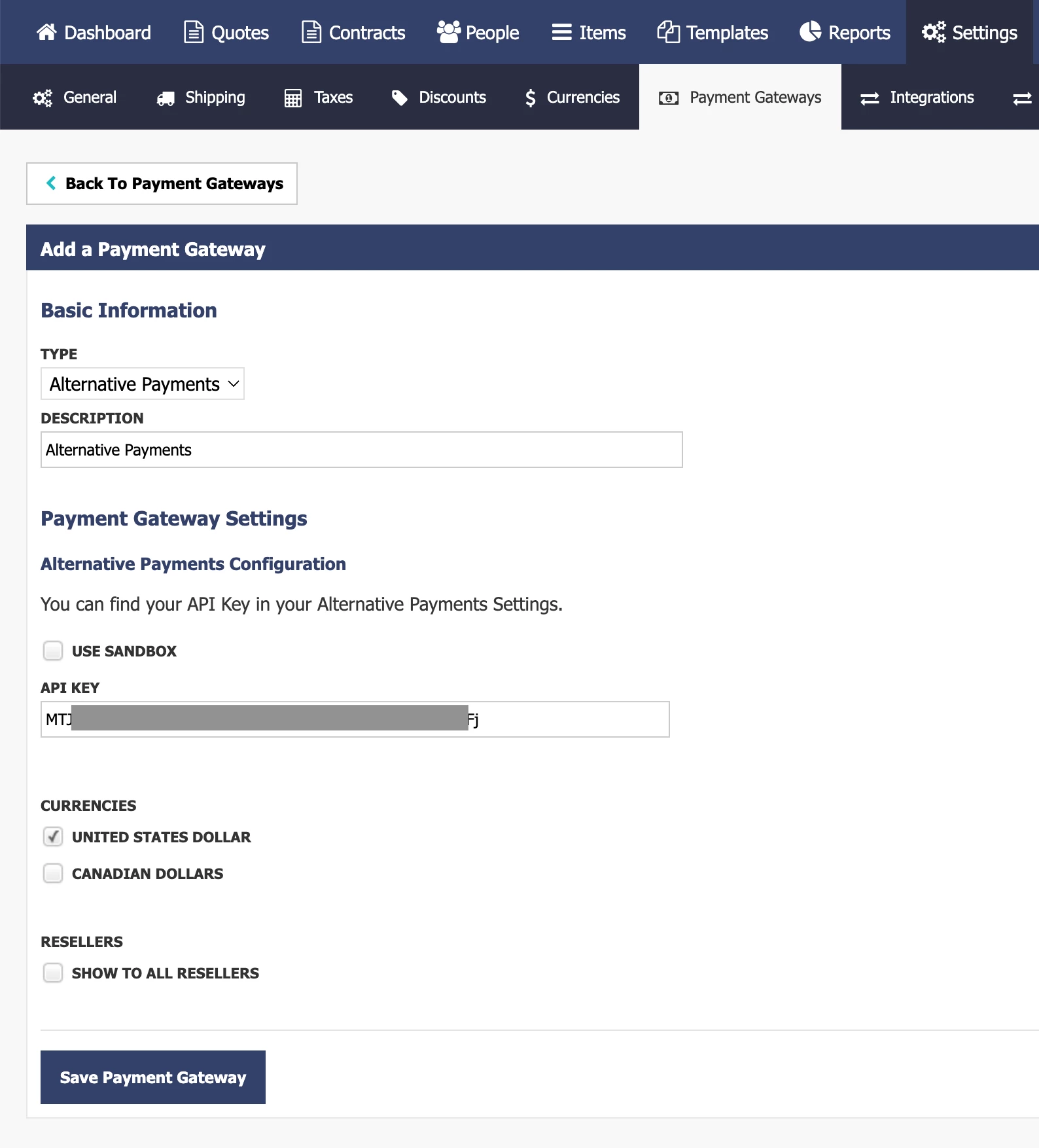

- Navigate to Settings > Payment Gateway and Add a Payment Gateway for Alternative Payments (it’s now on the dropdown). You’ll see this:

- Add a Description, and paste/enter the API access key generated in Alternative Payments.

Be sure to follow the complete instructions in the Help Center to ensure everything is connected correctly: https://help.quoter.com/hc/en-us/articles/39316407213083-Adding-Alternative-Payments-as-a-payment-gateway-to-your-Quoter-account.

We Value Your Feedback

If you’ve read this far, we know you care (at least a little…) and we want to hear from you. Drop your thoughts or suggestions in the comments below. Your feedback helps us improve.

Not using Quoter yet? Reach out to your ScalePad Account Manager or request a demo to see how Quoter can help your team close more profitable deals, faster.